Introduction

In today’s uncertain economic climate, investors are increasingly turning to precious metals as a safeguard for their financial future.

Is Noble Gold Investments a Scam?

Noble Gold Investments has emerged as a notable player in this space, offering gold IRAs and precious metals investment options since 2016.

With the rise of investment scams and fraudulent companies, it’s crucial to thoroughly investigate any financial institution before entrusting them with your hard-earned money. This comprehensive review examines Noble Gold Investments’ legitimacy, services, and customer experiences.

Our investigation covers:

- Company background and leadership

- Available investment options and fees

- Storage facilities and security measures

- Customer reviews and ratings

- Real experiences from current investors

Whether you’re considering a gold IRA for retirement planning or looking to diversify your portfolio with precious metals, this detailed analysis will help you determine if Noble Gold Investments aligns with your financial goals and security needs.

Is Noble Gold Investment a Scam?

Noble Gold Investments, founded in 2016 by Collin Plume, has established itself as a newer precious metals IRA company with a clear mission: making precious metals investing accessible to everyone. The company’s dedication to transparency and education sets it apart from potential scam operations.

Noble Gold Investments is a trusted name in the world of gold IRAs, and their reputation speaks for itself.

Though they were only founded in 2016, Noble Gold has quickly earned the respect and trust of its customers. Many Americans have already turned to them to help diversify and protect their retirement savings. Whether you’re looking to invest in precious metals or just want reliable guidance, Noble Gold has built a solid track record of customer satisfaction.

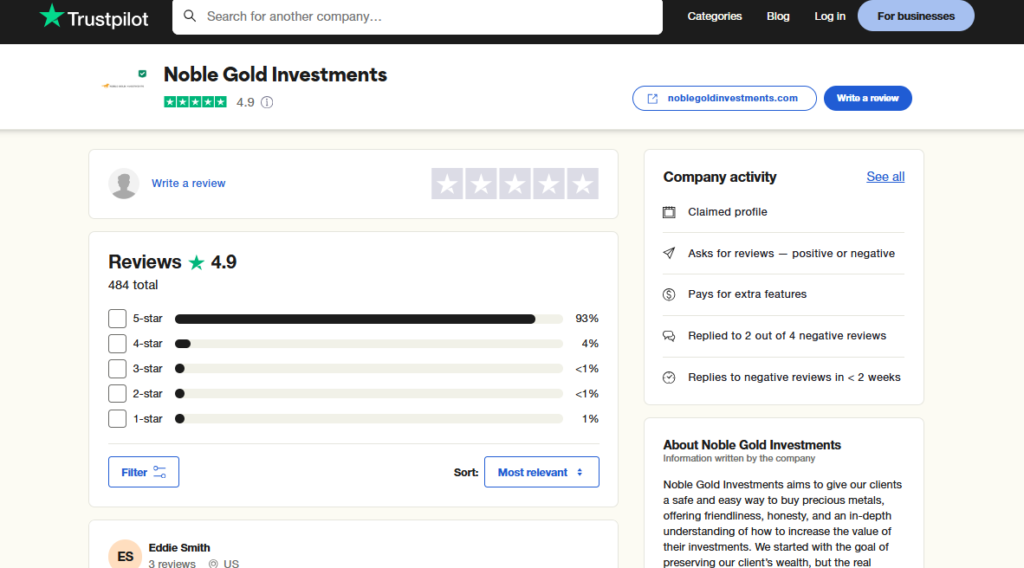

The company’s reputation shines across several major review platforms, with many satisfied clients sharing their experiences:

- BBB: 4.99/5 stars (based on 152 customer reviews)

- ConsumerAffairs: 5/5 stars (based on 739 customer reviews)

- TrustPilot: 4.9/5 stars (based on 147 customer reviews)

- Trustlink: 5/5 stars (based on 127 customer reviews)

- Birdeye: 4.9/5 stars (based on 505 customer reviews)

- Google My Business: 4.9/5 stars (based on 461 customer reviews)

- Yelp: 5/5 stars (based on 1 customer review)

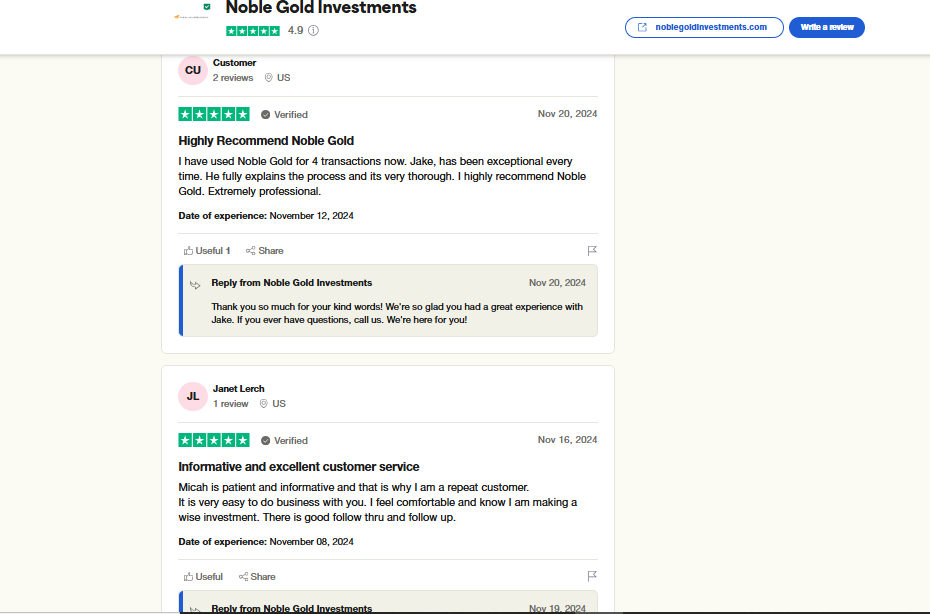

Here are a few examples of the positive feedback Noble Gold Investments has received from its customers:

As you can see, people really seem to appreciate the service and care that Noble Gold provides. While they don’t have a profile on Sitejabber, their glowing ratings across the board speak volumes about the positive impact they’ve had on their customers’ financial futures.

Here are just a few examples of the kind of feedback Noble Gold gets from clients:

[Include a few customer testimonials here]

It’s clear that when it comes to securing your retirement with precious metals, Noble Gold is a company you can trust.

Let’s take a closer look at the benefits and features that make Noble Gold Investments stand out in the world of gold IRA companies.

Services Offered by Noble Gold

Their service offerings include:

- Gold and Silver IRAs: Self-directed retirement accounts backed by physical precious metals

- Direct Precious Metals Sales: Purchase of gold, silver, platinum, and palladium for personal possession

- Royal Survival Packs: Curated collections of precious metals for emergency preparedness

- Rare Coins: Investment-grade numismatic coins for collectors and investors

Reputation and Customer Feedback

The company’s elite customer service reputation is backed by verified customer experiences. A thorough investigation reveals:

- A+ BBB rating with zero unresolved complaints

- 5-star ratings on TrustLink from authenticated customers

- Positive reviews highlighting personalized guidance and education

- Transparent fee structures and pricing

- Licensed and registered in all 50 states

- Verified storage facilities in Texas

Compliance and Educational Approach

Noble Gold maintains strict compliance with IRS regulations and industry standards. Their representatives focus on education rather than high-pressure sales tactics, providing detailed information about precious metals investing through free guides and consultations.

Partnerships for Security

The company’s legitimacy is further strengthened by their partnerships with established custodians and storage facilities, ensuring client assets are properly secured and insured.

Investing with Noble Gold: Pros, Cons, Fees & Transparency

Noble Gold Investments stands out in the precious metals industry with its competitive fee structure and diverse investment options. Let’s examine the key aspects of investing with this company:

Notable Advantages:

- Low minimum investment requirement of $2,000 for IRAs

- Diverse precious metals collection including gold, silver, platinum, and palladium

- Transparent pricing structure with no hidden fees

- Comprehensive buyback program with guaranteed fair market prices

Fee Structure:

- Setup fee: $80

- Annual maintenance fee: $100

- Storage fee: $150 (includes insurance)

- Total annual costs: $225 + custodian fees

The fee structure at Noble Gold remains competitive within the industry, offering value for investors seeking precious metals diversification.

Storage Options and Limitations

Noble Gold maintains secure storage facilities exclusively in Texas through partnerships with International Depository Services (IDS). While the Texas location provides:

- High-security storage

- Full insurance coverage

- Regular audits

- Segregated storage options

The single-state storage limitation might present challenges for investors outside Texas who prefer closer proximity to their investments.

Buyback Program Details

The company’s buyback program provides:

- No-questions-asked policy

- Market-competitive rates

- Quick processing times

- Zero penalties for selling back

Investment Options

Noble Gold’s diverse precious metals collection includes:

- Gold bars and coins

- Silver products

- Platinum investments

- Palladium options

- Rare numismatic coins

- Royal Survival Packs

The company maintains transparent pricing across all investment categories, with real-time market updates and clear documentation of all fees and charges. This transparency extends to their educational resources, helping investors understand the full cost implications of their investment decisions.

Eligible IRA Metals, Coins & How to Open a Gold IRA with Noble Gold

Noble Gold Investments provides a comprehensive selection of IRS-approved precious metals for your IRA investment. These metals meet strict purity requirements established by the IRS:

IRS-Approved Metals Available:

- Gold (minimum .995 fineness)

- Silver (minimum .999 fineness)

- Platinum (minimum .9995 fineness)

- Palladium (minimum .9995 fineness)

Popular Gold and Silver Coins Offered:

- American Gold Eagle coins

- Canadian Gold Maple Leaf

- Austrian Gold Philharmonic

- American Silver Eagle

- Canadian Silver Maple Leaf

- Australian Silver Kangaroo

Setting up your Gold IRA with Noble Gold follows a straightforward process:

- Initial Contact: Request their free gold IRA guide through their website

- Consultation: Speak with a Noble Gold specialist to discuss your investment goals

- Account Setup: Complete necessary paperwork for your new self-directed IRA

- Fund Transfer: Choose your funding method:

- Direct transfer from existing IRA

- 401(k) rollover

- Personal contribution

- Metal Selection: Pick your preferred precious metals with guidance from experts

The selection process deserves careful consideration. Your investment choices should align with your long-term financial goals and risk tolerance. Noble Gold’s specialists help you understand the historical performance, market dynamics, and potential benefits of each metal type.

Noble Gold distinguishes itself by providing educational resources throughout the setup process. Their specialists explain the nuances between different coins and bars, helping you make informed decisions about your precious metals portfolio. You receive detailed information about each product’s weight, purity, and market value before making your investment choice.

The company maintains competitive pricing on their products while ensuring all metals meet IRS requirements for inclusion in your retirement account. Each purchase includes verification of authenticity and proper documentation for your IRA custodian.

For those considering precious metals IRA investing in gold and silver, it’s essential to understand the intricacies involved in such investments.

Customer Reviews, Ratings & Final Thoughts on Noble Gold Investments

Noble Gold Investments maintains exceptional ratings across major review platforms, demonstrating strong customer satisfaction and service reliability:

- Better Business Bureau (BBB): A+ rating with zero complaints in the past three years

- TrustLink: Perfect 5-star rating from 128 verified customer reviews

- Consumer Affairs: 4.9/5 stars based on 89 ratings

These consistent high ratings reflect Noble Gold’s commitment to:

- Transparent pricing structure

- Responsive customer support

- Educational resources

- Professional handling of transactions

Customer testimonials highlight specific strengths:

“The team at Noble Gold walked me through every step of the process. Their knowledge and patience made me feel confident in my investment decisions.” – Sarah M., TrustLink

The investigation into Noble Gold’s business practices reveals several key indicators of legitimacy:

- State-registered business operations

- Verified storage facilities in Texas

- Clear documentation of all transactions

- Comprehensive insurance coverage

- Licensed and bonded status

- Regular third-party audits

The absence of regulatory issues, combined with positive customer experiences and transparent business practices, strongly suggests Noble Gold Investments operates as a legitimate precious metals dealer. Their established track record since 2016 demonstrates consistent service quality and reliability in the precious metals investment sector.

Making Informed Investment Decisions: Is Noble Gold Investments Right for You?

Rational investment decisions require thorough research and professional guidance. Before partnering with Noble Gold Investments, consider these essential steps:

- Consult a Financial Advisor: Discuss your investment goals and risk tolerance with a qualified professional who understands precious metals investments

- Review Your Portfolio Mix: Determine if gold IRAs align with your retirement strategy and existing investments

- Examine Your Budget: Assess if you can meet the $2,000 minimum investment requirement and ongoing fees

- Study Market Conditions: Research current precious metals market trends and economic indicators

Based on our investigation, Noble Gold Investments stands as a legitimate and trustworthy precious metals dealer. Their transparent fee structure, strong customer service record, and comprehensive educational resources make them particularly suitable for:

- First-time precious metals investors

- Retirement planners seeking portfolio diversification

- Investors who value personalized guidance

- Those looking for a reputable dealer with lower minimum investment requirements

Remember: precious metals investments carry risks. Your investment choices should reflect your personal financial situation and long-term goals.

FAQs (Frequently Asked Questions)

What is Noble Gold Investments?

Noble Gold Investments is a newer precious metals IRA company that focuses on providing financial security through investments in gold and other precious metals. The company aims to offer elite customer service and a diverse collection of investment options.

Is Noble Gold Investments a scam?

While there have been investigations into claims of scams, Noble Gold has established a reputation for strong customer service and holds an A+ rating from the Better Business Bureau (BBB). It’s important to conduct personal research and review customer feedback before making any investment decisions.

What are the fees associated with opening a gold IRA with Noble Gold?

Noble Gold Investments offers low minimum investment fees starting at $2,000. The annual fee for maintaining a gold IRA is $225, plus custodian fees. These fees are generally competitive compared to industry standards, and the company emphasizes transparent pricing.

What types of metals and coins can I invest in through Noble Gold?

Noble Gold offers a range of IRS-approved metals and coins for investment, including popular options like the American Gold and Silver Eagle. It is crucial to choose the right investment based on your financial goals.

How do I open a gold IRA with Noble Gold Investments?

Opening a gold IRA with Noble Gold involves a step-by-step process that includes requesting guides, scheduling consultations, and selecting funding options. The company provides support throughout the process to ensure you make informed decisions.

What do customer reviews say about Noble Gold Investments?

Customer reviews indicate a positive experience with Noble Gold Investments, highlighted by their BBB A+ rating and five-star ratings on TrustLink. These ratings suggest high service quality, but it’s advisable to review multiple sources for comprehensive insights.

What is Noble Gold Investments?

Noble Gold Investments is a newer precious metals IRA company that focuses on providing financial security through investments in gold and other precious metals. The company aims to offer elite customer service and a diverse collection of investment options.

Is Noble Gold Investments a scam?

While there have been investigations into claims of scams, Noble Gold has established a reputation for strong customer service and holds an A+ rating from the Better Business Bureau (BBB). It’s important to conduct personal research and review customer feedback before making any investment decisions.

What are the fees associated with opening a gold IRA with Noble Gold?

Noble Gold Investments offers low minimum investment fees starting at $2,000. The annual fee for maintaining a gold IRA is $225, plus custodian fees. These fees are generally competitive compared to industry standards, and the company emphasizes transparent pricing.

What types of metals and coins can I invest in through Noble Gold?

Noble Gold offers a range of IRS-approved metals and coins for investment, including popular options like the American Gold and Silver Eagle. It is crucial to choose the right investment based on your financial goals.

How do I open a gold IRA with Noble Gold Investments?

Opening a gold IRA with Noble Gold involves a step-by-step process that includes requesting guides, scheduling consultations, and selecting funding options. The company provides support throughout the process to ensure you make informed decisions.